Introduction : MOOWR

Objectives of the scheme

- To strengthen the ‘Make in India’ initiative

- To facilitate ‘ease of doing business’

- The promote ‘Foreign Direct Investments’

- To promote ‘India as the manufacturing hub globally’

To promote ‘India as the manufacturing hub globally’

- Fate of export-incentive schemes such as Export Promotion Capital Goods (EPCG), Special Economic Zone (SEZ) and Export Oriented Unit (EOU) uncertain due to the dispute at the World Trade Organization (WTO)

- When compared to other schemes, this scheme can give Competitive Edge.

- Merchant Export for India Scheme, no more attractive now.

- What new Foreign trade policy will come up with.

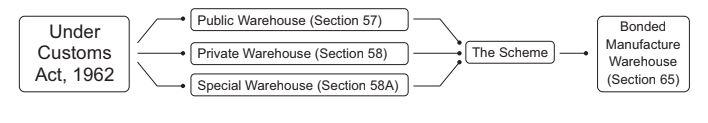

Different form of Warehousing

Central board of Indirect Taxes has come up with Manufacturing and Other operation procedure for both warehouses – Private as well as Special Warehouses

Different form of Warehousing

- A site or building that is licensed as such by the Principal Commissioner or Commissioner of Customs, as the case may be, under Section 57, wherein dutiable goods may be deposited.

- Includes licensing of public warehouse to an undertaking of Central /State government or Union Territory or Ports notified under Major

Ports Trust Act.

- A site or building that is licensed as such by the Principal Commissioner or Commissioner of Customs, as the case may be, under Section 58, wherein dutiable goods imported by or on behalf of the licensee may be deposited.

- The Principal Commissioner or Commissioner of Customs may, subject to conditions, license a special warehouse under Section 58A wherein dutiable goods (notified goods by the CBIC) may be deposited and such warehouse shall be caused to be locked by the Proper Officer and no person shall enter the warehouse or remove any goods therefrom without the permission of the Proper Officer.

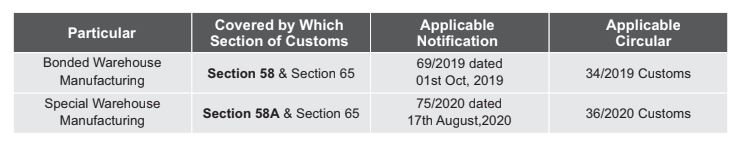

Bonded Manufacturing Warehouse - Section 65 and Section 58

- A customs bonded warehouse is a licensed premise where manufacturing and other operations such as packaging, labelling & repacking can be carried out on deferred payment of various duties (i.e. BCD, SWS and IGST) which are levied at the time of Import of goods in India.

- This Scheme benefits various manufacturers & global online retailers having e-commerce business which envisages for operations such as packaging, labelling, and repackaging.

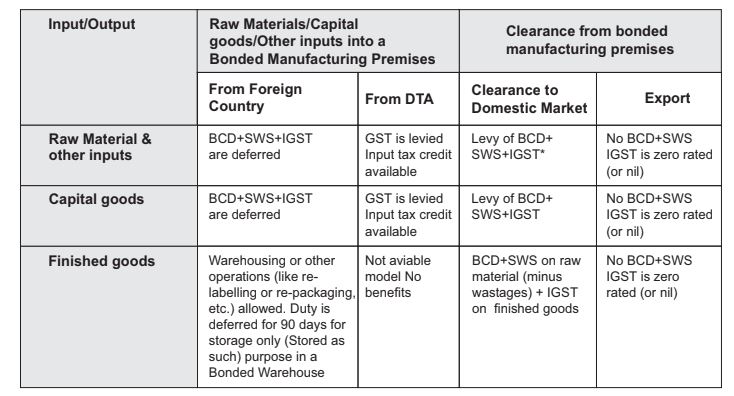

Why Bonded Manufacturing Warehouse

Advantage:- Duty is deferred, lets understand how it works?

* If cleared as such then interest is levied on duty deferred beyond 90 days

Note: When bonded goods are exported, refund of input taxes or IGST payable on export can be availed

Who Can Apply for the Scheme

Following Unit is eligible to apply for this Scheme:

- The Unit that operates under Section 65 or

- The Unit applying for the permission to operate under Section 65 of the act,

in warehouse licensed under Section 58 of the Act. (amended by notification 76/2020 Customs)*

Moreover Notification 77/2020, specifically says that for specified goods for Warehouse operating under section 58A, MOOWR 2019 will not apply and for Specified goods falling in category of Special Warehouse notification 75/2020 need to be referred upon. *Earlier in MOOWR 2019 regulation, regulation 3 has only one condition of Section 65, however through notification 76/2020, additional condition of Warehouse being licensed under Section 58 is added.

Advantages of Bonded Manufacturing

Commissioner of Customs acts asthesinglepointofcontactforall approvals.

Common application and approval form for a license for private bonded facility

and permission for manufacturing and other operations.

No application fee nor any incremental compliance cost other than setting up and maintenance of bonded warehouse.

Capitalandnon-capitalgoods(rawmaterials, components,etc..)can remain ware housed until clearance or consumption.

New manufacturing facility can be set up or an existing facility can be converted into a bonded manufacturing facility irrespective of its location in India.

Advantages of Bonded Manufacturing

Allrecordsofmanufacturingandotheroperationstobemaintained digitally in a single format as specified in Annexure B of MOOWR, 2019.

Goods can be transferred from the bonded facility to another facility without payment of duty.

No limit on quantum of clearances that can be exported or cleared to the domestic market.

With bonded manufacturing warehouse facility, various benefit / other schemes like EPCG, Advance authorization etc., can also be claimed.

The waste occurring on exporting of resultant product from bonded warehouse shall not be liable for any payment of import duty if such waste is destroyed.

Other advantages

- Only in case of Removal as such interest is payable of duty and tax after 90 days, in other case NO INTEREST IS to be paid.

- In case Domestic supplier want to import capital goods, the supplier can evaluate this scheme.

- This Scheme eligible for 100% Domestic supplier also.

- 100% Domestic supplier can save upon interest cost on working capital blockage in duties and taxes.

- There is NO application fees for the Scheme.

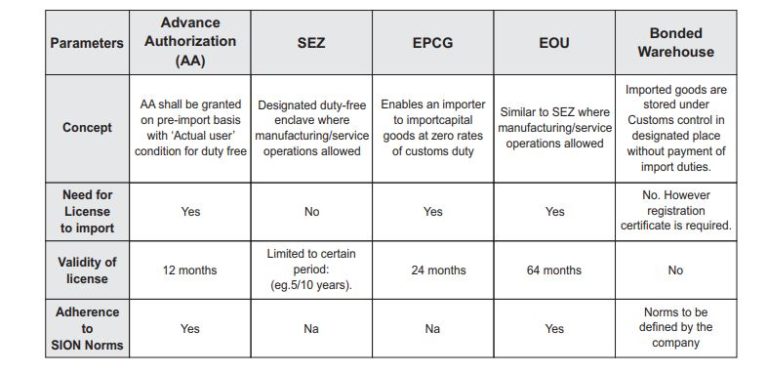

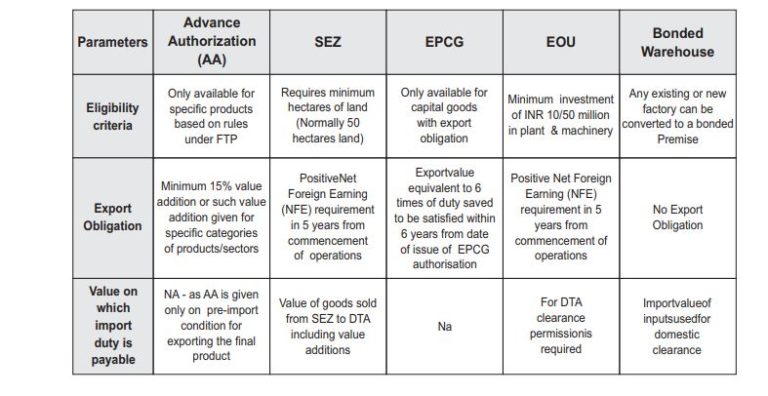

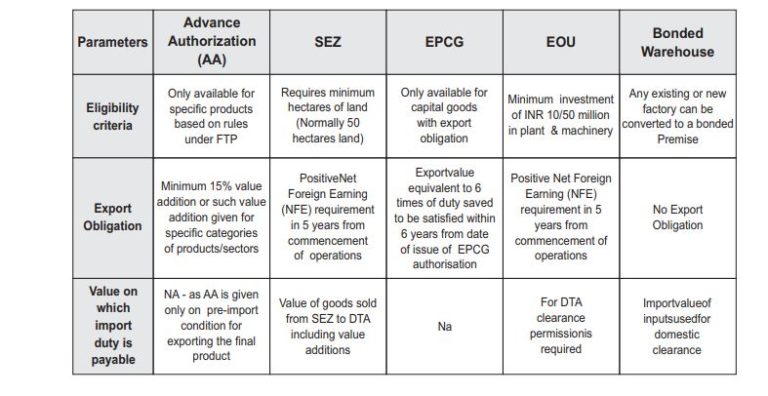

Why Bonded Manufacturing over Other Schemes?

Why Bonded Manufacturing Over Other Schemes?

Why Bonded Manufacturing Over Other Schemes?

Way forward

- Bonded Warehouse is great boost to business having manufacturing process and heavily dependent on Imports.

- Existing Business premises can be converted to Bonded Manufacturing Warehouses.

- Bonded warehouse in long run will promote Manufacturing in India- and will make India a global hub of manufacturing.

- Optimum Capacity utilization can be achieved by using a single Manufacturing facility to tap both Domestic and global Markets.